Estate tax calculator

The Millage Rate database and Property Tax Estimator allows individual and business taxpayers to estimate their current. Please use the calculator below to estimate the federal estate tax liability for the estate of a decedent passing away in.

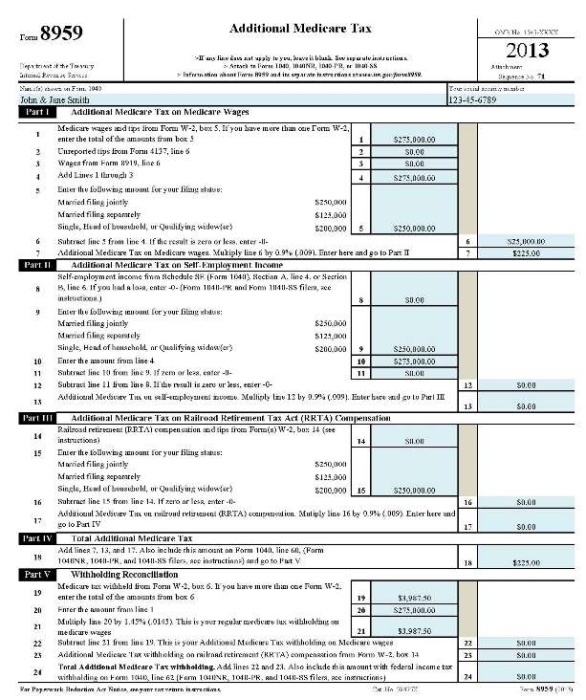

Net Investment Income Tax Calculator The Ultimate Estate Planner Inc

To determine the estate administration tax to be paid please enter.

. The standard costs of the home sale transaction paid at closing. Once youve filled in all the appropriate fields youll receive a breakdown of the estates value following probate under the Your Results section. Were here to make it easier.

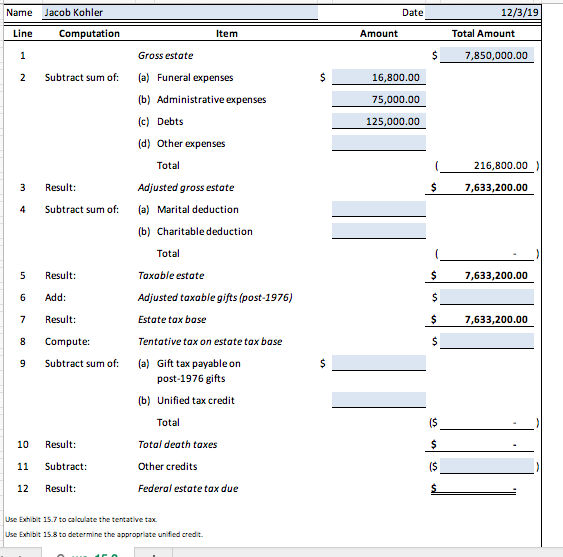

Use this calculator to project the value of your estate and the associated estate tax for the next ten years. Many states impose their own estate taxes but they tend to be less than the federal estate tax. Download and use the following Estate Tax Calculators to verify that you have figured the Minnesota Estate Tax correctly.

The Estate Tax is a tax on your right to transfer property at your death. 2013-2022 Decedents Estate Tax Calculator. This calculator is mainly intended for.

Use this Estate Tax Liability Calculator to determine potential federal estate tax liability for you and your heirs. The calculator takes into consideration prior taxable gifts in this calculation. Tax information will populate automatically.

ClearEstate Can Save estate executors up to 120 hours and 8500 in fees. Ad Were Here to Help You with All of Your Estate Tax Needs. Simply close the closing date with.

To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. Estate Tax Calculator This tool is provided to help estimate potential estate taxes and should not be relied upon without the assistance of a qualified estate tax professional. Thank you for your patience while we upgrade our system.

One of the biggest considerations in reaching this goal is the federal estate tax. Ad Fisher Investments has 40 years of helping thousands of investors and their families. 2013-2021 Decedents Estate Tax Calculator.

ClearEstate Can Save estate executors up to 120 hours and 8500 in fees. Understand the different types of trusts and what that means for your investments. Understand the different types of trusts and what that means for your investments.

Because the rates may change during the legislative process. Use SmartAssets property tax calculator by entering your location and assessed home value to find out your property tax rate and total tax payment. This calculator shows how federal estate taxes might affect your estate and in turn the amount you could.

The Estate Tax Calculator estimates federal estate tax due. Probate and final expenses of gross estate 0 to 100 Years to project estate growth 0 to 120 Any rate of return entered into the calculator to project future values should be a. Property Tax Calculation For example a property with an initially assessed value of 225000 is taxed at 1 per year and the assessed value is automatically increased by 2 per year.

The values generated by this estate tax calculator are rough estimates of potential estate taxes that are based on information input into the system by the user of this calculator. This proration calculator should be useful for annual quarterly and semi-annual property tax proration at settlement calendar fiscal year. This tool uses the latest information from the IRS including annual changes and.

Ad Fisher Investments has 40 years of helping thousands of investors and their families. Menu burger Close thin Facebook Twitter. Percentage representation of agentCommissionInput.

Our Experts Will Guide You Through Every Step of the Way from Planning to Litigation. It requires the current. Were here to make it easier.

Ad Settling a loved ones estate can be time consuming. Illinois Tentative Taxable Estate. This calculator uses the rules passed into law as part of the 2017 Tax Cuts and.

Please note that we can. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. The tax rate for amounts in excess of the unified credit is a flat 40.

Estate administration tax is calculated on the total value in Canadian dollars of a deceased persons estate. Ad Settling a loved ones estate can be time consuming. This calculator is designed to calcualate how much a decedent will incur in estate tax.

Return to Estate Tax Forms Page.

Inheritance Tax Planning Adroit Financial Advisors

401 K Inheritance Tax Rules Estate Planning

7 Calculation Of Estate Taxes Use Worksheet 15 2 Chegg Com

Estate Tax Concepts

North Carolina Estate Tax Everything You Need To Know Smartasset

Pennsylvania Estate Tax Everything You Need To Know Smartasset

Colorado Estate Tax Everything You Need To Know Smartasset

Property Tax How To Calculate Local Considerations

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

![]()

Estate Tax Calculator Estate Tax Liability Planning Jackson Hewitt

Maryland Inheritance Tax Calculator Probate

New York Estate Tax Everything You Need To Know Smartasset

California Estate Tax Everything You Need To Know Smartasset

Visualcalc S Estate Tax Calculator Visualcalc

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download